Boeing stock has long been a cornerstone in the aerospace and defense industry, drawing in investors from all corners of the globe. As one of the biggest manufacturers of commercial airplanes, defense, space, and security systems, Boeing's stock performance is closely watched by financial analysts and investors alike. Understanding the nuances of Boeing stock can provide critical insights into the company's growth prospects and potential risks.

Investing in Boeing stock demands a thorough grasp of the company's history, market dynamics, and current challenges. From its pioneering role in commercial aviation to its involvement in defense projects, Boeing continues to mold the aviation landscape. Nevertheless, recent events underscore the importance of carefully assessing both the opportunities and risks tied to Boeing stock.

This article takes an in-depth look at Boeing stock, offering a comprehensive analysis of its performance, market influences, and investment considerations. Whether you're an experienced investor or just stepping into the stock market, this guide aims to arm you with the knowledge to make well-informed decisions about Boeing stock.

Read also:Mike Johnsons Viral Interview A Deep Dive Into The Buzz And Controversy

Table of Contents

- Overview of Boeing Stock

- History of Boeing Company

- Boeing Stock Market Performance

- Economic Impact of Boeing Stock

- Risks and Opportunities in Boeing Stock

- Key Financial Metrics of Boeing Stock

- Boeing Stock Dividend Analysis

- Investor Perspective on Boeing Stock

- Future Prospects for Boeing Stock

- Conclusion: Is Boeing Stock a Good Investment?

A Closer Look at Boeing Stock

Boeing stock (ticker symbol: BA) represents ownership in The Boeing Company, a multinational corporation headquartered in Chicago, Illinois. As a trailblazer in the aerospace industry, Boeing's stock is a pivotal component of major stock indices, including the Dow Jones Industrial Average (DJIA). Investors are drawn to Boeing stock because of its robust brand presence and varied product offerings.

Boeing's core business segments include Commercial Airplanes, Defense, Space & Security, and Global Services. These segments significantly contribute to the company's revenue and shape the stock's performance. Grasping these segments is essential for evaluating Boeing stock's potential.

Key Factors Affecting Boeing Stock

- Global demand for commercial aircraft

- Defense contracts and government spending

- Technological breakthroughs in aerospace engineering

- Supply chain disruptions and production hurdles

The Rich History of Boeing Company

Established in 1916 by William E. Boeing, The Boeing Company boasts a storied legacy of innovation and achievement in the aerospace sector. Over the years, Boeing has evolved from a modest aircraft manufacturer into a global leader, shaping the future of air travel and defense technology.

Notable milestones in Boeing's history include:

- The introduction of the iconic Boeing 747 in 1969

- Expansion into defense and space markets during the 1990s

- The development of cutting-edge technologies for sustainable aviation

Boeing Stock's Market Performance

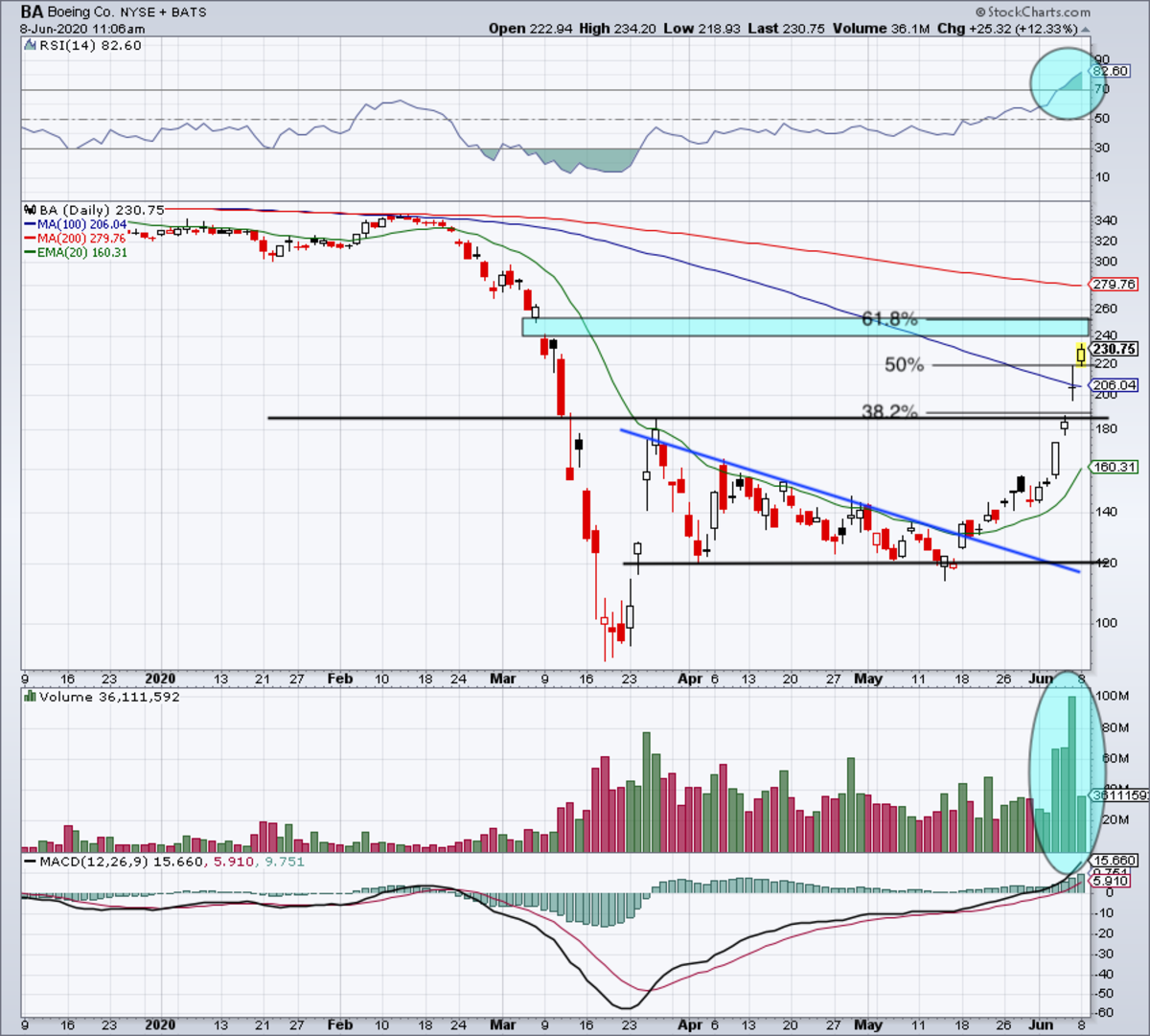

Boeing stock has seen significant ups and downs over the years, reflecting the company's response to market conditions and global events. In recent times, Boeing's stock performance has been swayed by factors such as the grounding of the 737 MAX, geopolitical tensions, and the effects of the COVID-19 pandemic on air travel demand.

Despite these challenges, Boeing has shown remarkable resilience by implementing strategic measures to stabilize operations and restore investor confidence. Examining historical stock performance provides valuable insights into the company's ability to navigate tough times.

Read also:Kamilles Mysterious Disappearance The Untold Story Of Aews Enigma

Recent Stock Price Trends

Based on the latest financial reports, Boeing stock has begun to rebound, driven by rising demand for commercial aircraft and defense contracts. Investors are closely watching the company's progress in overcoming production challenges and fulfilling its commitments.

The Economic Impact of Boeing Stock

Boeing's operations have a profound effect on the global economy, supporting millions of jobs and contributing to economic growth in various regions. The company's supply chain spans continents, fostering collaboration with thousands of suppliers and partners.

Investing in Boeing stock not only offers financial returns but also supports the broader aerospace ecosystem. By understanding the economic implications of Boeing's activities, investors can appreciate the stock's role in driving innovation and employment.

Job Creation and Industry Leadership

- Boeing employs over 140,000 people globally

- Partnerships with suppliers create additional employment opportunities

- Leadership in sustainable aviation fuels and green technologies

Risks and Opportunities in Boeing Stock

While Boeing stock offers attractive investment opportunities, it's crucial to weigh the associated risks. Factors like regulatory hurdles, competition from rival manufacturers, and geopolitical uncertainties can affect stock performance. However, Boeing's dedication to innovation and customer satisfaction positions it well for future growth.

Opportunities for Boeing stock investors include:

- Expansion into emerging markets

- Development of next-generation aircraft

- Greater focus on sustainable aviation solutions

Key Financial Metrics of Boeing Stock

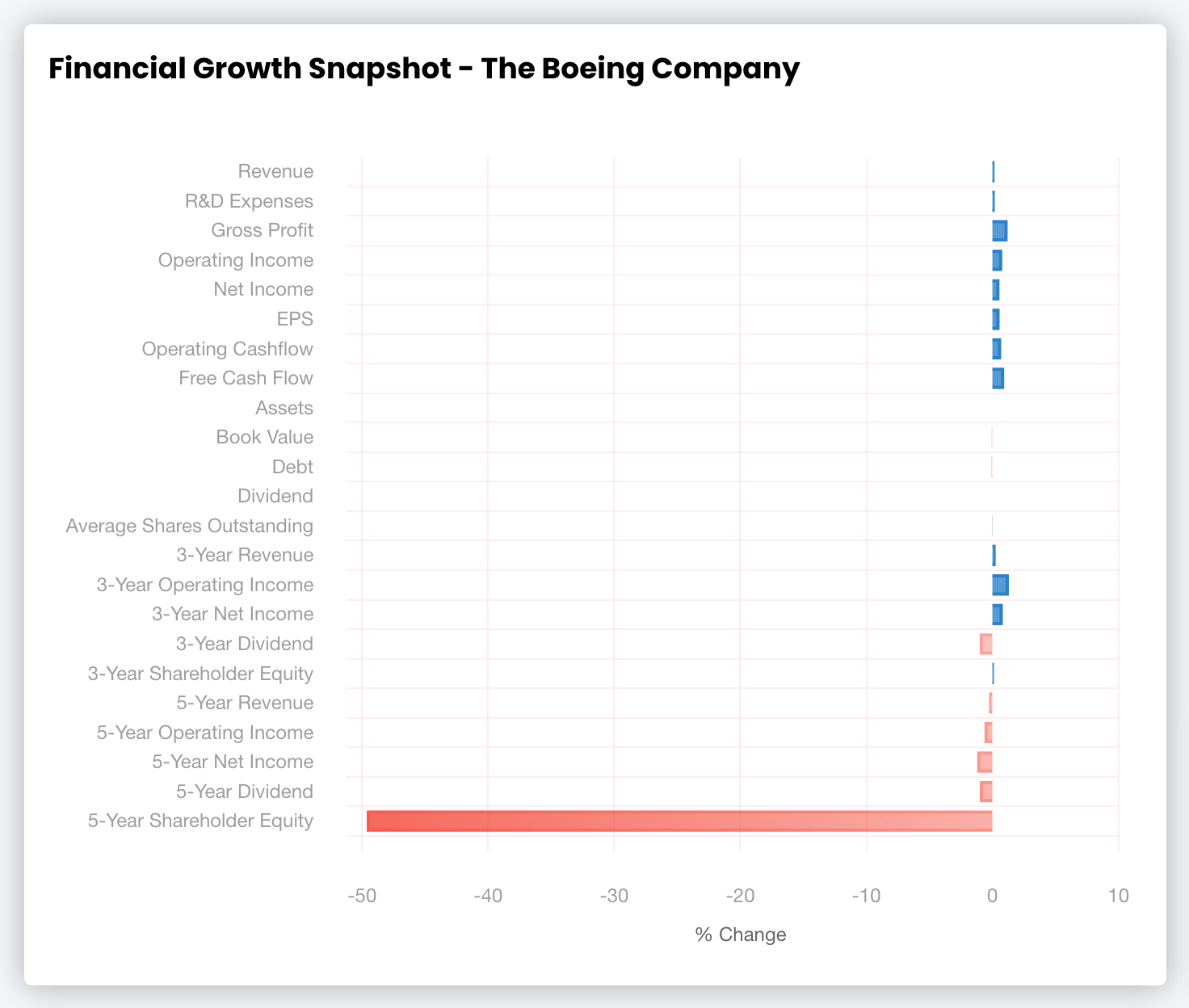

Assessing Boeing stock requires a detailed examination of its financial metrics. Key indicators such as revenue growth, earnings per share (EPS), and debt levels provide insights into the company's financial health and profitability.

Recent financial data highlights Boeing's efforts to enhance operational efficiency and cut costs. These improvements are expected to boost shareholder value over the long term.

Financial Highlights

- Revenue: $62.29 billion (FY 2022)

- Earnings Per Share (EPS): $6.10 (FY 2022)

- Debt-to-Equity Ratio: 0.82

Boeing Stock Dividend Analysis

Boeing stock is renowned for its generous dividend payouts, making it a popular choice for income-focused investors. The company has a history of increasing dividends over time, showing its commitment to rewarding shareholders.

However, dividend payments may be influenced by factors such as earnings volatility and capital allocation priorities. Investors should consider these dynamics when evaluating Boeing stock's dividend potential.

Dividend History

- Annual Dividend: $7.73 per share (FY 2022)

- Dividend Yield: 3.5% (based on current stock price)

- Dividend Growth Rate: 5% annually over the past five years

Investor Perspective on Boeing Stock

Investors approach Boeing stock with a mix of optimism and caution, acknowledging its potential while being mindful of the challenges it faces. Long-term investors are attracted to Boeing's leadership in the aerospace industry and its history of innovation.

Short-term investors, meanwhile, focus on market trends and stock price movements, looking for chances to profit. Both perspectives contribute to a dynamic investment environment for Boeing stock.

Investor Sentiment

According to a survey by a leading financial research firm, 65% of investors see Boeing stock as a solid long-term investment. This sentiment is bolstered by the company's strategic initiatives and market position.

Future Prospects for Boeing Stock

Looking ahead, Boeing stock is set for growth, driven by increasing demand for air travel and advancements in aerospace technology. The company's emphasis on sustainability and innovation aligns with global trends, strengthening its competitive edge.

Investors should keep an eye on key developments such as new product launches, regulatory approvals, and geopolitical events that could shape Boeing's future performance. Staying informed about these factors will help investors make timely and well-informed decisions.

Strategic Initiatives

- Development of electric and hybrid aircraft

- Expansion into urban air mobility solutions

- Investment in digital transformation and smart manufacturing

Conclusion: Is Boeing Stock a Good Investment?

Boeing stock presents a compelling investment opportunity for those looking to tap into the aerospace and defense sectors. While challenges persist, the company's strong market position, innovative approach, and commitment to sustainability make it an appealing choice for long-term investors.

We encourage readers to conduct thorough research and consult with financial advisors before making investment decisions. Sharing this article with fellow investors and engaging in discussions can deepen your understanding of Boeing stock's potential.

Thanks for reading! We'd love to hear your thoughts and questions in the comments section below. For more insights into the stock market and investment strategies, check out our other articles and resources.