Life insurance isn’t just another financial product—it’s your family’s safety net, giving you peace of mind no matter what life throws your way. Imagine this: you’re not around, but your loved ones still need financial support to pay bills, cover college tuition, or maintain their lifestyle. That’s where a solid life insurance policy steps in. Whether you're just starting your career, raising kids, or planning for retirement, understanding life insurance is key to building a secure future.

Let’s face it—many people don’t give life insurance the credit it deserves. They think it’s only for those with dependents, but that couldn’t be further from the truth. This financial tool does so much more than cover funeral costs. It ensures your beneficiaries have financial support when you’re gone. In today’s fast-paced world, where healthcare costs and living expenses keep climbing, life insurance is more than just a nice-to-have; it’s a must-have for anyone who wants to protect their family’s financial well-being.

In this guide, we’re diving deep into everything you need to know about life insurance. From the basics to advanced strategies, we’ll break it all down. We’ll cover the different types of policies available, the factors to consider when buying coverage, and how to make the most of your policy. By the time you finish reading, you’ll have a rock-solid understanding of how life insurance can protect your future and leave a legacy that lasts.

Read also:The Inspiring Journey Of Buscar Kid And His Mom

Table of Contents

- What Is Life Insurance?

- Types of Life Insurance

- Why Life Insurance Matters

- How Life Insurance Works

- Choosing the Right Policy

- Costs and Premiums

- Beneficiaries and Claims

- Tax Implications

- Common Mistakes to Avoid

- Future Trends in Life Insurance

What Is Life Insurance?

At its heart, life insurance is a contract between you and an insurance company. Here’s how it works: you agree to pay regular premiums, and in return, the insurer promises to pay a lump sum of money to your designated beneficiaries when you pass away. This financial arrangement is like a safety net for your loved ones, ensuring they can handle financial obligations even after you’re gone.

Think about it—life insurance is all about managing risks. Instead of leaving your family to deal with unexpected expenses, you transfer that burden to the insurer. It’s not just about covering funeral costs or paying off debts; it’s about securing things like your kids’ education, paying off the mortgage, or providing a steady income for your spouse. Life insurance is one of the best tools out there for making sure your family is taken care of, no matter what happens.

Key Features of Life Insurance

- Death Benefit: The big payout your beneficiaries receive when you pass away.

- Premiums: The regular payments you make to keep your policy active.

- Policy Term: How long your policy lasts before it expires or needs renewal.

- Cash Value (in some policies): A feature that lets you build savings over time, which can be a nice bonus.

Types of Life Insurance

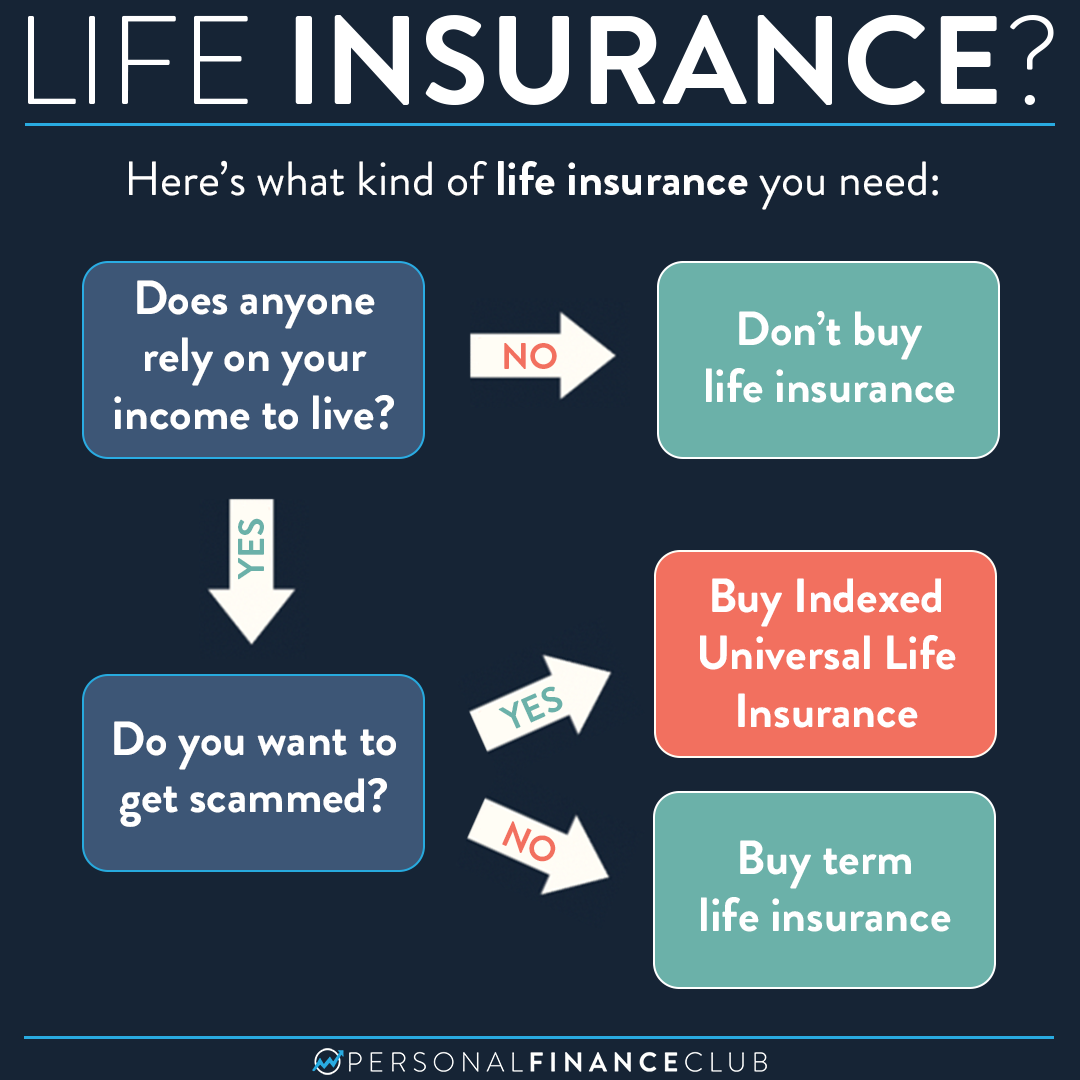

Not all life insurance policies are created equal. Depending on your needs, different types of coverage might suit you better. Let’s break it down so you can pick the right one for you and your family.

Term Life Insurance

Term life insurance is like renting a safety net for a specific period—usually between 10 and 30 years. It’s typically more affordable than permanent policies and works great for people who only need coverage for a certain amount of time, like while they’re working or raising kids. If you’re looking for temporary protection, term life insurance is a solid choice.

Whole Life Insurance

Whole life insurance is the gold standard of coverage—it lasts your entire life and comes with a cash value component that grows over time. While the premiums are higher than term policies, you get a guaranteed death benefit and the option to use the cash value as an investment. If you’re thinking long-term, this could be the ticket.

Universal Life Insurance

Universal life insurance is kind of like the best of both worlds. It combines the flexibility of term coverage with the cash value growth of whole life policies. You can adjust your premiums and coverage amounts, making it a great choice for people who want customizable protection. It’s like having your cake and eating it too.

Read also:Zoe Perry The Rising Star Whorsquos Capturing Hearts

Why Life Insurance Matters

Here’s the deal: life insurance isn’t just a luxury—it’s a necessity for anyone with financial responsibilities. Let me give you a few reasons why it’s so important:

First, it provides financial security for the people who depend on you, ensuring they can keep living the way they’re used to. Second, it helps cover debts and expenses, like your mortgage, student loans, or medical bills. And third, life insurance can help fund future goals, like paying for your kids’ education or setting up a retirement fund for your loved ones.

Statistical Evidence

According to LIMRA, about 40% of U.S. households don’t have enough life insurance coverage. That’s a pretty staggering number, and it shows just how many people are at risk of leaving their families in a tough spot. If you haven’t evaluated your protection needs yet, now’s the time to do it.

How Life Insurance Works

The way life insurance works is pretty straightforward. When you buy a policy, you agree to pay regular premiums in exchange for a guaranteed death benefit. The insurer looks at your risk profile—things like your age, health, and lifestyle—to figure out how much your premiums should be.

When the policyholder passes away, the beneficiaries file a claim with the insurance company. Once everything’s verified, the insurer sends the death benefit to the grieving family, giving them some financial relief during a tough time. It’s a smooth process that helps your loved ones transition without added stress.

Underwriting Process

- Medical Examination: The insurer checks your health to assess your risk.

- Risk Assessment: Factors like your age, job, and hobbies are evaluated.

- Premium Calculation: Based on all these factors, the insurer determines how much your coverage will cost.

Choosing the Right Policy

Picking the right life insurance policy isn’t something you should rush into. You need to think carefully about your financial obligations and future needs. For example, if you have young kids, you might want a policy that covers their education expenses. If you’re close to retirement, a policy with a cash value component could be more practical.

Factors to Consider

- Amount of Coverage: Figure out how much financial protection your family will need.

- Policy Duration: Decide if you want term or permanent coverage based on your goals.

- Cost: Compare premiums and make sure the policy fits your budget in the long run.

- Reputation of the Insurer: Choose a company with a strong track record and solid financial ratings.

Costs and Premiums

The cost of life insurance depends on a bunch of factors, like your age, health, and how much coverage you need. Generally, younger people with no major health issues pay less in premiums. Policies with shorter terms or fewer benefits tend to be cheaper too.

It’s smart to shop around and compare quotes from different insurers to get the best deal. Many companies have online tools that let you estimate premiums, making it easier to see your options. Just remember, cost is important, but it shouldn’t be the only thing you consider when making your decision.

Ways to Save on Premiums

- Buy coverage while you’re younger to lock in lower rates.

- Stay healthy to qualify for better rates.

- Check if your employer offers group insurance at a discount.

- Bundle policies with the same insurer to get additional discounts.

Beneficiaries and Claims

Designating beneficiaries is a crucial step in the life insurance process. Beneficiaries are the people or organizations that get the death benefit when the policyholder passes away. It’s super important to update your beneficiary information regularly, especially after big life changes like getting married or having a child.

When it comes time to file a claim, beneficiaries need to give the insurer a certified copy of the death certificate and the policy document. The insurer will review everything and send out the funds according to the policy’s terms. While the process is usually pretty smooth, it’s always a good idea to check the insurer’s guidelines to make sure everything goes off without a hitch.

Tips for Beneficiary Designation

- Choose both primary and contingent beneficiaries.

- Specify percentages if there are multiple beneficiaries.

- Avoid naming minors as direct beneficiaries.

- Review and update beneficiary information at least once a year.

Tax Implications

Life insurance comes with some great tax perks that make it even more appealing. In most cases, the death benefit paid to beneficiaries is tax-free. Plus, the cash value part of permanent policies grows without being taxed right away, letting policyholders build wealth without worrying about immediate tax liabilities.

However, there are some situations where taxable events might happen. For example, if you sell or transfer the policy for valuable consideration, any gain could be taxed. It’s always smart to talk to a tax professional or financial advisor to understand how your specific policy might affect your taxes.

Key Tax Benefits

- Tax-free death benefit for beneficiaries.

- Tax-deferred growth of cash value.

- Potential tax deductions for business-related policies.

Common Mistakes to Avoid

Life insurance is a powerful tool, but people often make mistakes that can hurt its effectiveness. Here are a few common pitfalls to watch out for:

- Purchasing inadequate coverage: If you underinsure yourself, your loved ones could be left financially vulnerable.

- Choosing the wrong policy type: Picking a policy that doesn’t fit your needs can waste resources.

- Ignoring inflation: Failing to account for inflation when figuring out coverage amounts can reduce the policy’s value over time.

- Not reviewing policies regularly: Life changes, and your policy should change with it.

Future Trends in Life Insurance

The life insurance industry is changing fast, thanks to technology and shifting consumer preferences. One big trend is the use of digital tools for managing policies and processing claims. Insurers are also using data analytics and artificial intelligence to improve underwriting accuracy and customer service.

Another exciting trend is the integration of wellness programs into life insurance policies. By encouraging policyholders to live healthier lifestyles, insurers aim to reduce risks and improve outcomes for everyone involved. As these trends continue to evolve, consumers can expect more personalized and efficient insurance solutions.

Innovations in the Industry

- Mobile apps that make managing your policy a breeze.

- Telemedicine options for quick and easy health assessments.

- Sustainability-focused policies that support eco-friendly practices.

Conclusion

Life insurance is a cornerstone of financial planning, offering protection, peace of mind, and long-term security for you and your loved ones. By understanding the different types of policies, evaluating your needs, and choosing the right coverage, you can ensure your family stays financially stable even if you’re not around. Remember to review your policy regularly and consult professionals when needed to get the most out of it.

We encourage you to take action by reviewing your current coverage and exploring options that align with your financial goals. Share this article with your friends and family to