When the Trump administration rolled out its budget proposal, it set off a firestorm of debate. At its core, the plan seemed to favor the wealthy while leaving the less fortunate behind. During Donald Trump's presidency, this budget was closely examined for its potential to widen income inequality and weaken social welfare programs. Critics quickly pointed out that the policies heavily leaned toward tax cuts for the rich and reduced essential services for the poor, which could deepen the economic divide in the United States.

The ripple effects of this budget are far-reaching, touching everything from healthcare and education to social security. To truly understand the Trump budget and its potential impact, it's crucial to dive deep into the details. This article will give you a comprehensive look at the Trump budget, breaking down its key elements and the criticism it’s received. Whether you're a policymaker, a concerned citizen, or just someone curious about where the U.S. economy is headed, this piece will provide you with valuable insights into the controversial Trump budget proposal.

By analyzing the data and listening to expert opinions, we'll explore how the Trump budget tips the scales toward aiding the wealthy and what that could mean for low-income families. So, buckle up and let’s dig into the numbers and the stories behind them.

Read also:Craig Kimbrels Return To The Atlanta Braves A Gamechanging Move

Getting to Know the Trump Budget Proposal

A Quick Look at the Trump Budget

The Trump budget proposal, officially titled "A Better Way: A Vision for a Confident America," is a roadmap for reshaping the American economy. One of the standout features of this budget is its commitment to cutting federal spending while also handing out big tax breaks, mostly benefiting high-income individuals and corporations.

According to the White House, the budget aims to fire up economic growth by lowering taxes and cutting back on regulations. But not everyone is on board with this plan. Critics argue that these measures mostly benefit the wealthy, making income inequality even worse. For instance, the proposal slashes the corporate tax rate from 35% to 21%, which has been one of the biggest points of contention.

Breaking Down the Trump Budget

Here’s a closer look at the key parts of the Trump budget proposal:

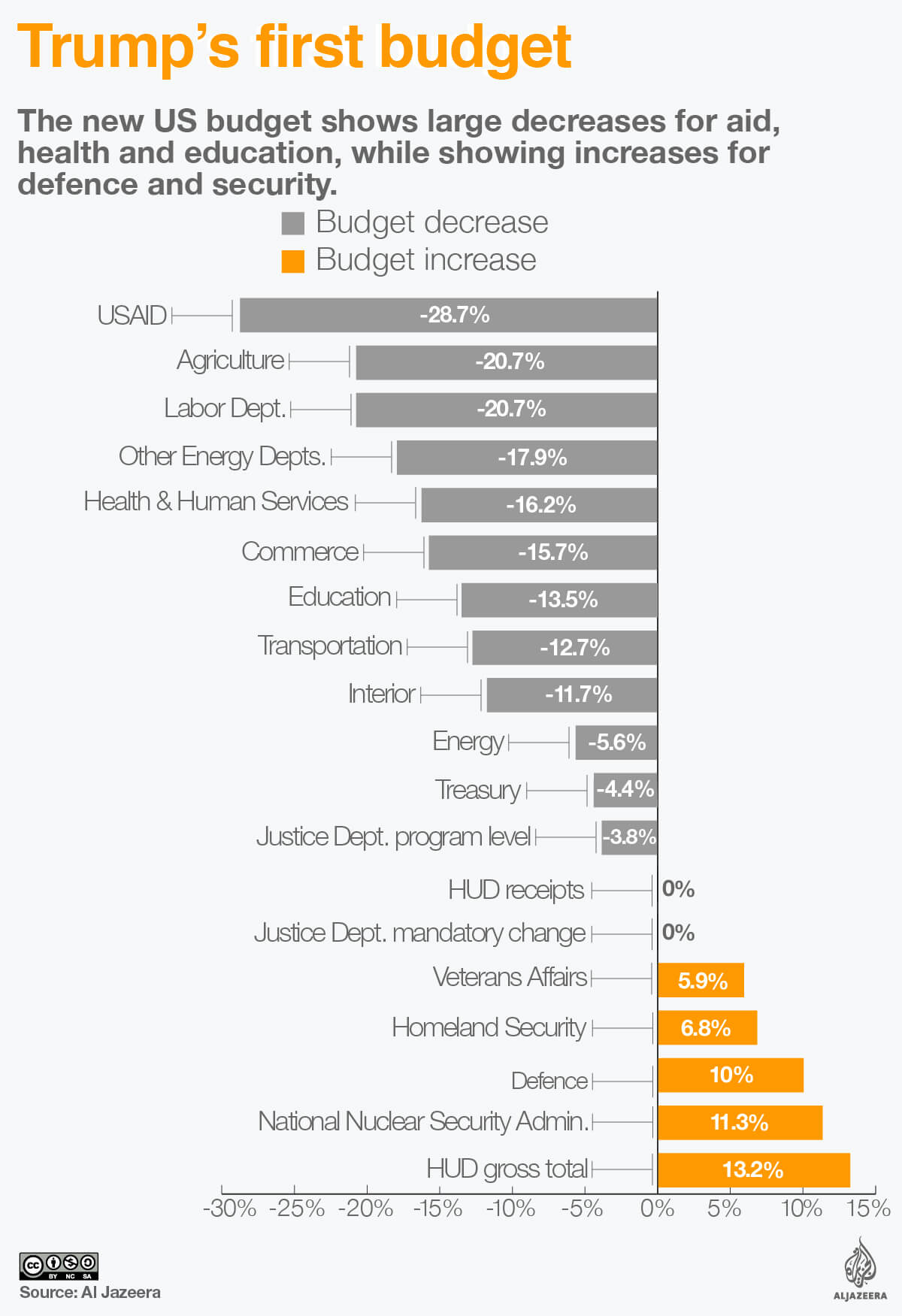

- Tax Cuts for Corporations and High-Income Earners: The budget suggests cutting corporate taxes and reducing the number of individual tax brackets, which mostly helps the wealthy.

- Reducing Federal Spending: The proposal involves cuts to several federal programs, like Medicaid, food stamps, and housing assistance, which hit low-income families the hardest.

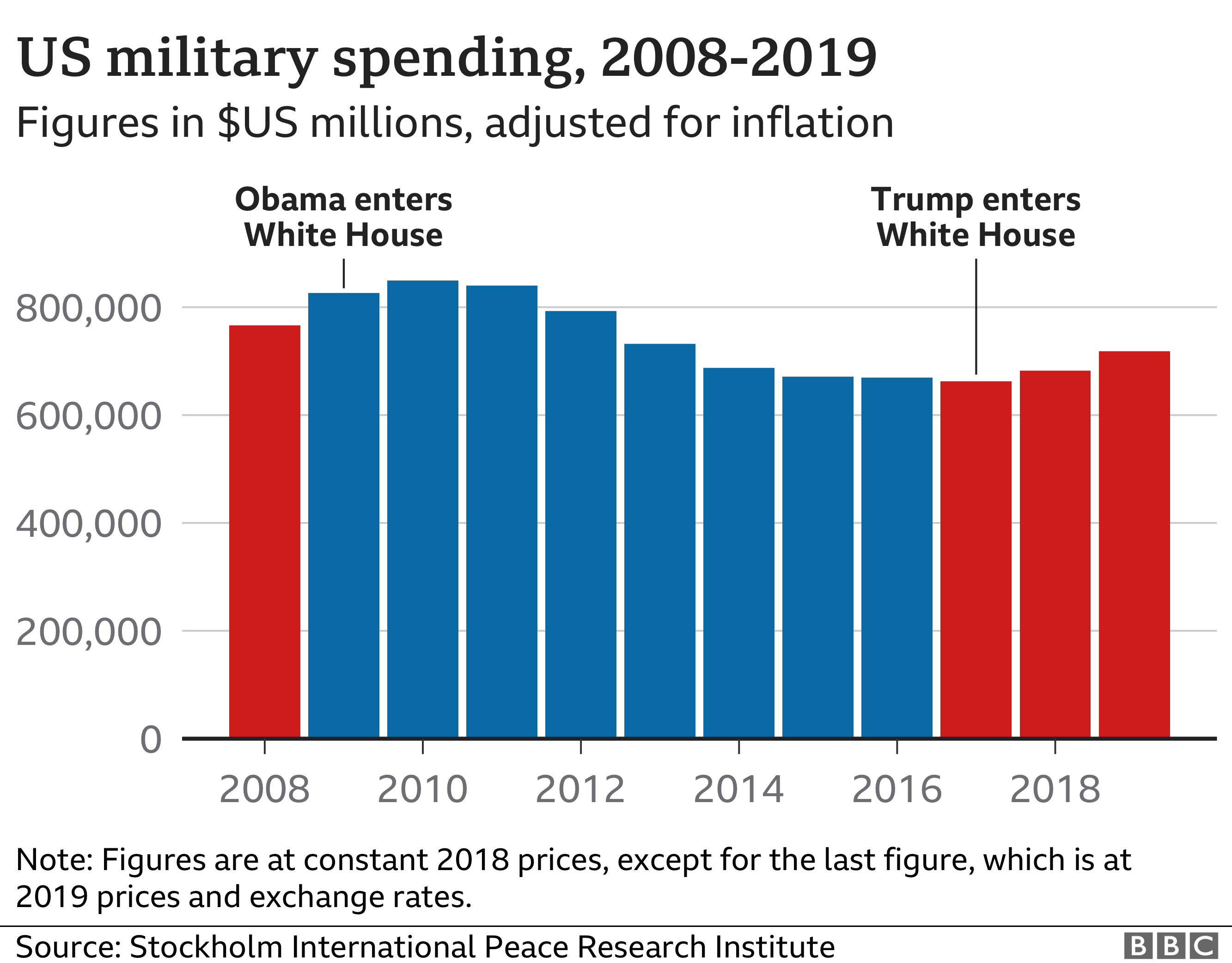

- Boosting Military Spending: The budget sets aside a large chunk of federal funds for defense, showing the administration's dedication to strengthening national security.

These elements highlight the administration's priorities, which many feel favor the wealthy over the less fortunate.

What Does This Mean for Income Inequality?

The Trump budget's focus on tax cuts for the wealthy has raised eyebrows over its potential to worsen income inequality. A report from the Tax Policy Center shows that the proposed tax cuts would mostly benefit the top 1% of earners, with little trickling down to middle- and low-income households.

Income inequality has been a growing concern in the U.S., with the gap between the rich and poor widening over the years. Critics believe that the Trump budget makes this problem worse by cutting social safety nets while giving hefty financial breaks to the wealthy.

Read also:Julie Hagerty The Comedy Legend Who Made Us Laugh And Love Her

Social Welfare Programs in Jeopardy

Medicaid on the Chopping Block

One of the most talked-about aspects of the Trump budget is its proposed cuts to Medicaid, a program that provides healthcare to millions of low-income Americans. The administration argues that these cuts are necessary to rein in federal spending and balance the budget. However, advocates for Medicaid warn that such reductions could leave many vulnerable populations without access to essential healthcare services.

Food Stamps and Housing Assistance Under Fire

On top of Medicaid, the Trump budget also suggests major cuts to food stamp programs and housing assistance. These programs are lifelines for millions of Americans struggling to make ends meet. By trimming funding for these initiatives, the budget risks pushing more families into poverty and increasing homelessness.

Economic Growth and the Trump Budget

Supporters of the Trump budget claim that its tax cuts and deregulatory measures will give the economy a much-needed boost, benefiting all Americans in the long term. The administration argues that lower taxes will encourage businesses to invest more, leading to job creation and higher wages. But economists are split on this issue, with some doubting that the benefits of such policies will reach the lower and middle classes.

What Do People Think?

The Trump budget proposal has faced a lot of flak from political foes and independent analysts alike. Many argue that it puts the interests of the wealthy first while ignoring the needs of the less fortunate. For example, a survey by the Pew Research Center found that most Americans think the tax cuts favor the rich and do little to address the concerns of everyday citizens.

How Does It Compare to Other Budgets?

Obama vs. Trump: A Clash of Ideologies

Compared to the budgets proposed during the Obama administration, the Trump budget takes a very different approach. While the Obama administration focused on expanding social welfare programs and raising taxes on the wealthy, the Trump administration wants to reduce government involvement in the economy and give tax breaks to corporations and high-income earners.

Other Administrations: A Look Back

Over time, budget proposals have varied a lot depending on the political leanings of the administration in charge. The Trump budget fits more with Republican beliefs in limited government and free-market economics, whereas Democratic administrations have typically emphasized social welfare and income redistribution.

What Does the World Think?

The Trump budget has caught the attention of international observers, who worry about its potential impact on global economic stability. By lowering taxes and boosting military spending, the budget could affect trade relationships and international cooperation. Critics also argue that the budget's focus on aiding the wealthy could hurt the U.S.'s reputation as a global leader in promoting economic equality and social justice.

What Do the Experts Say?

Economists and policy experts have chimed in on the Trump budget, offering a range of opinions on its potential effects. Some, like economist Laurence Kotlikoff, warn that the budget's focus on tax cuts could lead to long-term fiscal instability. Others, such as analysts from the Heritage Foundation, believe that cutting government spending is key to promoting economic growth.

Final Thoughts

To sum it up, the Trump budget proposal has sparked heated debates because of its focus on helping the wealthy while cutting back on social welfare programs. By exploring the key parts of the budget and their possible outcomes, we can better grasp its implications for income inequality and economic growth in the United States.

We’d love to hear what you think about this topic. Feel free to share your thoughts and check out other articles on our site for more insights into economic policy and its impact on society. Together, we can build a deeper understanding of the complex issues shaping our world today.

Table of Contents

- Getting to Know the Trump Budget Proposal

- What Does This Mean for Income Inequality?

- Social Welfare Programs in Jeopardy

- Economic Growth and the Trump Budget

- What Do People Think?

- How Does It Compare to Other Budgets?

- What Does the World Think?

- What Do the Experts Say?

- Final Thoughts