Getting a tax refund feels like finding a hidden treasure, especially when it's a big one like $11k. But what happens when the IRS makes a mistake and stops that refund in its tracks? Let's break it down and talk about how to fix it so you can get your money back where it belongs—your pocket.

Tax season is already stressful, and when the IRS messes up, it can feel like the world’s spinning out of control. Believe it or not, IRS errors happen more often than you think, and they can delay or even block your refund. In this guide, we’re going to walk you through why these errors happen, how to spot them, and—most importantly—how to fix them so you don’t lose out on what’s rightfully yours.

By the time you finish reading, you’ll have a solid game plan to deal with IRS errors, protect your finances, and make sure that $11k refund (or whatever amount you're owed) isn't stuck in limbo forever. Let’s dive in!

Read also:Bian Tian Yang And Jiang Zhi Nan A Journey Of Love Talent And Resilience

Table of Contents

- What Exactly Is an IRS Error?

- Why Does the IRS Make Mistakes Anyway?

- When the IRS Blocks Your $11k Refund

- How Do You Know if the IRS Screwed Up?

- Step-by-Step Guide to Fixing IRS Errors

- How Can You Stop This from Happening Again?

- Your Rights as a Taxpayer

- Frequently Asked Questions About IRS Errors

- Why You Should Consider Expert Help

- Wrapping It Up

What Exactly Is an IRS Error?

Let’s start with the basics. An IRS error is any mistake made by the Internal Revenue Service during the processing of your tax return. These mistakes can range from simple math errors to much bigger issues, like mixing up your identity or applying the wrong tax laws. Even though the IRS tries hard to avoid errors, they’re not perfect—they’re run by people and machines, and both can make mistakes.

When the IRS messes up, it can mess up big time. You might get a delayed refund, the wrong amount, or, worst of all, no refund at all. Sometimes, the IRS will send you a notice saying something’s off, but other times, you might not even know there’s a problem until your refund is MIA. That’s why understanding what these errors look like is the first step in fixing them.

Types of IRS Errors

- Processing Errors: These happen when the IRS is reviewing your tax return and something goes wrong.

- Mathematical Errors: Yep, the IRS can miscalculate things too, like how much tax you owe or how much you should get back.

- System Errors: Technology isn’t always reliable, and glitches in the IRS system can cause problems.

- Human Errors: IRS employees are people too, and sometimes they make mistakes while handling your tax return.

Why Does the IRS Make Mistakes Anyway?

So, why does the IRS trip up sometimes? There are a few common reasons, and they’re not always your fault. Here’s what often goes wrong:

1. Incorrect Taxpayer Information

This is one of the biggest culprits behind IRS errors. It could be something as simple as typing in the wrong Social Security Number (SSN), having a mismatched name or address, or even picking the wrong filing status. One little typo can snowball into a big headache.

2. Duplicate Filings

Imagine filing your taxes twice—once electronically and once on paper—for the same year. The IRS system gets confused, and that confusion can lead to errors. It’s like sending two invitations to the same party; the guest doesn’t know which one to RSVP to.

3. Identity Theft

Identity theft is a growing problem, and it can really throw a wrench in your tax plans. If someone uses your personal info to file a fake tax return, the IRS might block your legitimate refund while they investigate. It’s like someone stealing your identity and trying to cash in on your hard work.

Read also:Unpacking The World Of Express Your Ultimate Guide

When the IRS Blocks Your $11k Refund

Now, let’s talk about the big one: what happens when the IRS blocks your $11k refund? For many people, that kind of money is a lifeline—whether it’s for paying bills, paying off debt, or saving for the future. Losing access to it because of an IRS error can be a major financial blow.

Understanding the Impact

When your refund gets blocked, it can throw your entire financial plan off track. Maybe you were counting on that $11k to cover a big expense, or maybe you were planning to invest it in something important. Whatever the case, it’s crucial to act fast to fix the problem and get your refund back where it belongs. The sooner you tackle the issue, the sooner you’ll see that money in your bank account.

How Do You Know if the IRS Screwed Up?

Spotting an IRS error early can save you a ton of time and frustration. Here’s what to watch out for:

1. Delayed Refund

If your refund is taking way longer than expected, it could be a sign of trouble. The IRS usually processes electronic refunds within 21 days and paper refunds within six weeks. If yours is dragging on longer than that, it might be worth checking into.

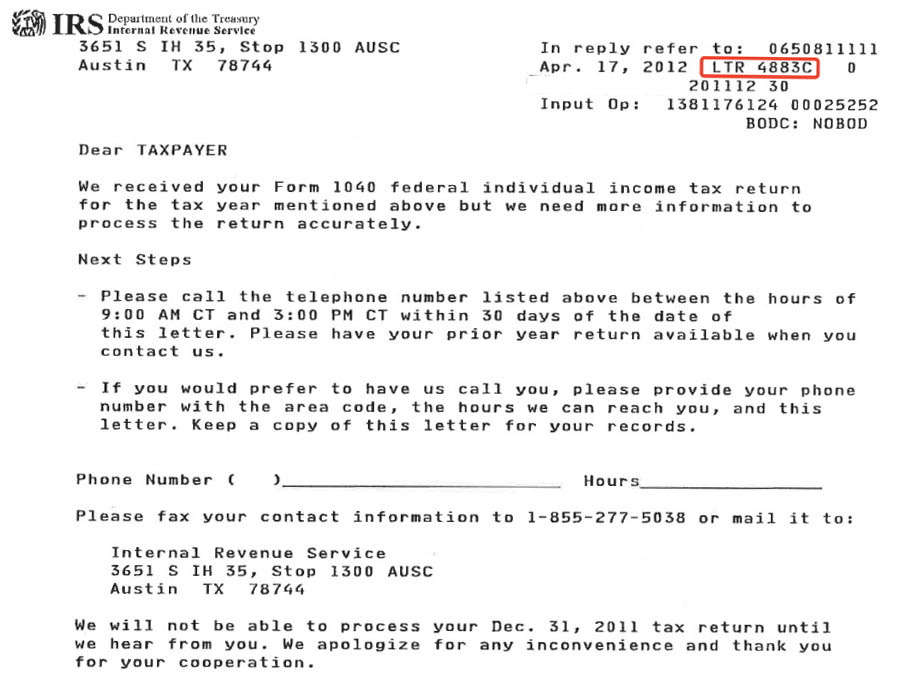

2. IRS Notices

Sometimes, the IRS will send you a notice letting you know there’s an issue with your tax return. These notices usually explain what’s wrong and what you need to do to fix it. They’re like a warning sign that something’s off, so don’t ignore them.

3. Online Tracking Updates

The IRS has an online tool that lets you track the status of your refund. If the status stays stuck on “processing” for a really long time, it could mean there’s an error. Think of it like a package that’s stuck in transit—it’s not moving, and that’s usually a bad sign.

Step-by-Step Guide to Fixing IRS Errors

Fixing an IRS error isn’t always easy, but it’s definitely doable. Here’s how to tackle it step by step:

1. Gather Documentation

Before you reach out to the IRS, make sure you have everything you need. This includes a copy of your tax return, proof of your identity, and any other financial records that might help. Being prepared is key to getting the issue resolved quickly.

2. Contact the IRS

The IRS offers several ways to get in touch, including phone, mail, and online forms. Choose the method that works best for you and be ready to provide all the information they need. It might take a little while to get through, but persistence pays off.

3. Seek Professional Help

If you’re struggling to fix the issue on your own, don’t hesitate to call in the pros. Tax professionals and attorneys specialize in dealing with IRS problems and can be a huge help. They’ll guide you through the process and make sure your case is handled properly.

How Can You Stop This from Happening Again?

While some IRS errors are out of your control, there are steps you can take to reduce the risk:

1. Double-Check Your Tax Return

Before you hit “send” on your tax return, give it a thorough once-over. Make sure everything’s accurate, especially your SSN, name, and address. A little extra time spent proofreading can save you a lot of headaches later.

2. File Electronically

Filing your taxes electronically can cut down on errors because it eliminates the need for manual data entry. Plus, most tax software has built-in checks to catch mistakes before you submit your return. It’s like having a built-in proofreader.

3. Protect Your Personal Information

Identity theft is a real threat, so take steps to protect your personal info. Keep an eye on your credit reports, and report any suspicious activity to the IRS right away. It’s like putting up a security system to keep the bad guys out.

Your Rights as a Taxpayer

The IRS Taxpayer Bill of Rights spells out the protections you have as a taxpayer. Some of the key rights include:

- The Right to Be Informed: The IRS has to clearly explain any issues with your tax return and what you need to do to fix them.

- The Right to Quality Service: You deserve to be treated fairly and respectfully by the IRS.

- The Right to Challenge the IRS’s Position and Be Heard: If you disagree with the IRS, you have the right to explain your side of the story.

- The Right to Appeal an IRS Decision: If you’re not happy with how the IRS handles your case, you can appeal their decision.

Knowing your rights gives you the power to stand up for yourself when dealing with IRS errors or disputes. It’s like having a legal shield to protect you.

Frequently Asked Questions About IRS Errors

1. How Long Does It Take to Resolve an IRS Error?

It really depends on how complicated the issue is. Simple errors might get fixed in a few weeks, but more complex cases can take several months. Patience is key, but don’t be afraid to follow up if things seem to be dragging on too long.

2. Can I File a Complaint Against the IRS?

Absolutely! If you feel like the IRS isn’t treating you fairly, you can file a complaint. The Taxpayer Advocate Service is there to help you resolve disputes and make sure your voice is heard.

3. What Happens If the IRS Owes Me Money?

If the IRS owes you a refund, they’ll send it once the error is resolved. In some cases, they might even pay interest on the delayed refund. It’s like getting a little bonus for waiting.

Why You Should Consider Expert Help

Facing an IRS error on your own can feel overwhelming, but getting expert advice can make the process smoother. Tax professionals and attorneys specialize in navigating IRS issues, and they can provide valuable guidance. According to a report by the National Taxpayer Advocate, working with a tax professional can increase your chances of a favorable outcome by up to 50%. That’s a pretty good reason to get some help.

Wrapping It Up

IRS errors, especially ones that block big refunds like $11k, can be super frustrating and financially stressful. But by understanding what causes these errors and taking proactive steps to fix them, you can protect your finances and make sure you get what’s rightfully yours.

Here’s a quick recap of what to do:

- Identify IRS errors early by keeping an eye on your refund status and watching for notices.

- Gather all the necessary documentation to support your case.

- Contact the IRS promptly to start resolving the issue.

- Don’t hesitate to seek professional help if you need it.

Share this article with anyone who might find it helpful, and feel free to leave your questions or comments below. Stay informed and empowered when it comes to your taxes—it’s your money, and you deserve to keep it!

For more resources, check out the IRS website or talk to a trusted tax advisor. Your financial well-being is worth fighting for, so don’t give up until you get what you’re owed!