Listen up, folks. The 10-year treasury note isn’t just another financial instrument—it’s a critical piece of the puzzle that shapes how money moves in our economy. It's like the heartbeat of financial markets, influencing everything from interest rates to economic health. If you're an investor, an economist, or just someone curious about how the economy works, this note is something you need to know about.

Let me break it down for you. The 10-year treasury is like the weather vane for long-term interest rates. Analysts watch it closely to gauge the mood of the economy. Its ups and downs can affect everything from your mortgage rates to how much it costs for companies to borrow money. It's not just a number on a screen—it’s a reflection of what’s happening in the world of finance.

In this guide, we’re going deep into the world of the 10-year treasury. We’ll explore what it is, why it matters, and how it impacts both individual investors and the economy at large. By the time you’re done reading, you’ll have a solid grasp of why this financial tool is so important. So, buckle up—it’s time to dive in.

Read also:Kris And Kylie Jenner Powerhouse Matriarch And The Youngest Selfmade Billionaire

Table of Contents

- Introduction to the 10-Year Treasury

- What is the 10-Year Treasury?

- How Does the 10-Year Treasury Work?

- The Importance of the 10-Year Treasury

- Impact on the Economy

- Factors Affecting the 10-Year Treasury

- Market Signals from the 10-Year Treasury

- The 10-Year Treasury from an Investor's Perspective

- Risks and Rewards of Investing in the 10-Year Treasury

- Future Outlook for the 10-Year Treasury

Introduction to the 10-Year Treasury

Think of the 10-year treasury note as the golden standard for U.S. and global financial markets. Issued by the U.S. Department of the Treasury, it’s essentially a loan you make to the government for a decade. Why is it so special? Because it’s backed by the full faith and credit of the U.S. government, making it one of the safest investments out there.

Investors all over the globe lean on the 10-year treasury yield as a benchmark to evaluate risk in other financial instruments. It's like the steady rock in a stormy sea, offering modest returns with minimal risk. That stability makes it a go-to option for folks who want to protect their money while still earning a little something on the side.

And here’s the kicker: policymakers use the 10-year treasury to gauge how effective their monetary policies are and to spot potential shifts in the economy. It’s not just a financial tool—it’s a strategic one too.

What is the 10-Year Treasury?

Alright, let’s get technical for a moment. The 10-year treasury is a government bond with a maturity period of—you guessed it—10 years. It’s part of the U.S. Treasury's lineup of fixed-income securities, which also includes Treasury bills (T-bills), notes, and bonds. These are the tools the government uses to raise cash for public projects and manage national debt.

But here’s the thing: unlike stocks, which give you a piece of ownership in a company, the 10-year treasury is more like a loan. When you buy one, you’re essentially lending money to the government. In return, you get regular interest payments, known as coupons, every six months until the bond matures. At that point, you get your original investment back.

Here are some key features to keep in mind:

Read also:How Montgomery County Steps Up For Displaced Federal Workers

- Maturity: 10 years

- Interest Payments: Every six months

- Face Value: Typically $1,000

- Risk Profile: Very low risk

How Does the 10-Year Treasury Work?

The process of issuing and trading 10-year treasury notes is pretty straightforward, but it’s worth understanding. First, the U.S. Treasury holds auctions where investors—both domestic and international—can bid on these notes. The auction determines the price and yield of the notes based on how much demand there is.

Once they’re out there, the 10-year treasury notes can be traded in what’s called the secondary market. Here, their price can go up or down depending on a bunch of factors, like inflation, Federal Reserve policies, and what’s happening in the global economy. When more people want to buy these notes, the price goes up, and the yield goes down. If demand drops, the opposite happens.

Primary Auction Process

During the auction, investors submit bids saying how much they’re willing to pay for the notes. The Treasury starts accepting bids from the highest price and keeps going until they’ve sold all the notes they want to issue. This competitive bidding ensures that the notes are priced fairly and distributed efficiently.

Secondary Market Trading

Once the notes are out in the secondary market, they’re bought and sold by institutional and individual investors. Here, the price is influenced by things like inflation expectations, what the Federal Reserve is doing, and broader economic conditions. It’s like a live auction happening all the time.

The Importance of the 10-Year Treasury

The 10-year treasury is a big deal in the financial world for a lot of reasons. For starters, it’s the benchmark for long-term interest rates. That means it influences everything from mortgage rates to how much it costs companies to borrow money. Economists and investors watch its yield closely because it tells them a lot about the health of the economy.

Plus, it’s a key player in diversified investment portfolios. Its low-risk profile makes it a great choice for conservative investors who want to keep their money safe while still earning a little return. It’s like the ultimate backup plan.

Benchmark Role

As a benchmark, the 10-year treasury yield is used to price other fixed-income securities. For example, when companies issue bonds, they often compare them to the 10-year treasury yield and add a little extra to account for the added risk. It’s like a baseline that everything else is measured against.

Risk Management

Investors also use the 10-year treasury as a way to hedge against market volatility. When things get shaky, demand for these notes usually goes up, which drives down yields and gives investors a safe place to park their money. It’s like a life jacket in choppy waters.

Impact on the Economy

The 10-year treasury yield has a huge impact on the broader economy. Changes in the yield can affect how much it costs consumers to borrow money, whether it’s for a home, a car, or anything else. It also affects how much it costs companies to borrow, which can influence their decisions about expanding or investing.

Central banks, like the Federal Reserve, watch the 10-year treasury yield closely when they’re setting monetary policies. If the yield starts to rise, it might mean financial conditions are tightening, and they’ll adjust interest rates accordingly.

Housing Market

Mortgage rates are closely tied to the 10-year treasury yield. When the yield goes up, mortgage rates tend to follow, which can slow down the housing market. On the flip side, when the yield drops, mortgage rates often fall too, which can boost demand for homes.

Corporate Borrowing

Companies often issue bonds to raise money for operations or expansion. The 10-year treasury yield serves as a reference point for pricing these corporate bonds. If the yield is high, it means borrowing costs for businesses go up, which can affect their bottom line.

Factors Affecting the 10-Year Treasury

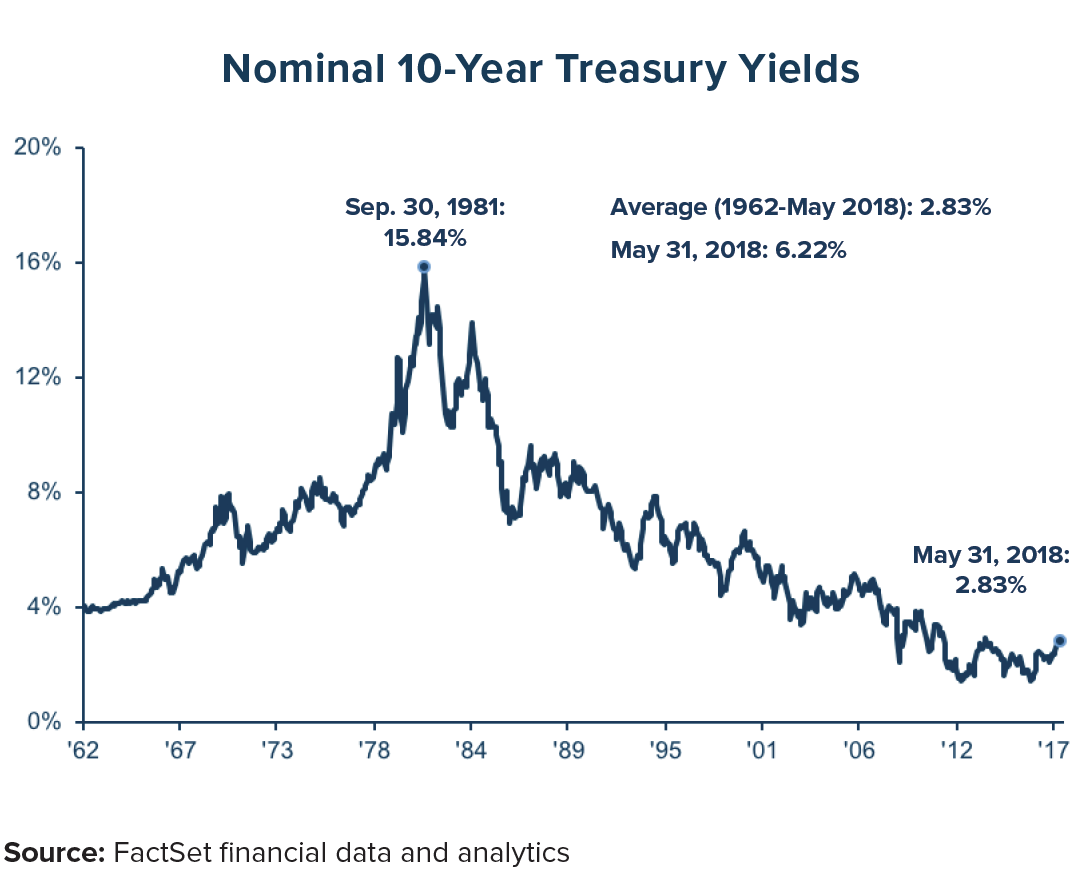

There are several factors that can influence how the 10-year treasury performs. Things like economic growth, inflation expectations, and central bank policies all play a role. Understanding these factors is key to predicting where the yield might go in the future.

For example, during periods of strong economic growth, investors might shift their focus to assets that offer higher returns, reducing demand for the 10-year treasury and driving yields higher.

Inflation Expectations

Inflation is a big deal when it comes to fixed-income investments. If people think inflation is going to rise, the 10-year treasury becomes less attractive because its fixed payments lose purchasing power over time. This often leads to higher yields as investors demand more compensation for the added risk.

Central Bank Policies

Monetary policies implemented by central banks, like quantitative easing or tapering, can have a big impact on the 10-year treasury yield. These policies affect the supply and demand dynamics of the notes, influencing their price and yield.

Market Signals from the 10-Year Treasury

The 10-year treasury yield gives us a lot of insight into market sentiment and economic conditions. For instance, when the yield curve steepens—meaning the 10-year yield rises compared to shorter-term yields—it often signals that people expect economic growth and inflation.

On the other hand, an inverted yield curve—where short-term yields are higher than the 10-year yield—can be a warning sign of a potential economic slowdown or even a recession. Historically, inverted yield curves have been a pretty reliable predictor of economic downturns, so they’re watched closely.

Yield Curve Analysis

Analysts use the yield curve, which plots yields across different maturities, to assess the health of the economy. A normal yield curve slopes upward, showing higher yields for longer maturities. Changes in the shape of the curve can give early warnings about shifts in the economy.

Investor Sentiment

The 10-year treasury yield also reflects how investors are feeling. When things get uncertain, investors often flock to the safety of government bonds, driving yields lower. This "flight to safety" can be a sign that there are concerns about economic stability.

The 10-Year Treasury from an Investor's Perspective

For investors, the 10-year treasury has a lot of advantages. It’s safe, liquid, and offers predictable income. But it’s not without its trade-offs. The returns might not be as high as riskier assets, but it’s a solid choice for those looking to balance risk and return in their portfolios.

Many investors use the 10-year treasury as part of a diversified portfolio strategy. By putting some of their money into these notes, they can reduce overall portfolio volatility while still getting some exposure to fixed-income returns. It’s like having a steady anchor in a sea of uncertainty.

Risk Management

One of the biggest benefits of the 10-year treasury is its role in risk management. During market downturns, these notes often perform better than riskier assets, providing a cushion against losses elsewhere in your portfolio. It’s like having a backup plan when things get rough.

Income Generation

For investors who are focused on income, the 10-year treasury offers predictable semi-annual interest payments. While the returns might not be as high as stocks or corporate bonds, they provide a reliable source of income in a low-risk environment. It’s like having a steady paycheck from your investments.

Risks and Rewards of Investing in the 10-Year Treasury

Like any investment, the 10-year treasury comes with its own set of risks and rewards. On the reward side, you get safety, liquidity, and predictable income. But there are risks to consider too, like interest rate risk, inflation risk, and opportunity cost.

Interest rate risk is the chance that prices will drop when interest rates rise. Inflation risk is the erosion of purchasing power over time, which can reduce the real value of your future payments. And opportunity cost is the idea that you could be earning more by investing in riskier assets.

Reward Factors

Here are some key rewards:

- Low Risk: Backed by the U.S. government

- Predictable Income: Regular interest payments

- Liquidity: Actively traded in the secondary market

Risk Factors